It doesn't matter if you are selling or buying a house. You need to be aware of the seller closing cost. Although the costs can vary from one state to another, they are generally between 6% and 10% of a house's sale price. These costs include the 6% broker fees, escrow fee, appraisal fees. Building flip tax, legal fees and other miscellaneous charges. These costs are typically paid by the seller. However, the buyer might be required to pay some.

The type of mortgage you take will determine the amount of money required to cover seller closing costs. You may be required to pay $1,750 upfront for insurance premiums on every $100,000 that you borrow. FHA financing may require that you pay annual mortgage insurance. You will need to pay higher rates for multifamily properties with at least four units.

There may also be other costs associated with the sale or purchase of a home, such as a property survey and prorated property taxes. You should also be prepared to pay for unpaid homeowner's association dues and liens against the property.

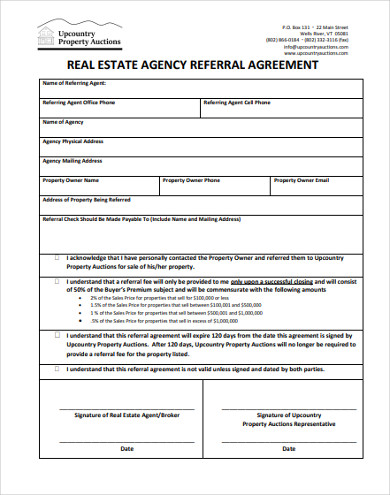

Other types of seller closing costs can be negotiated, such as a reduced rate on owner's insurance. Talk to your agent about any possible concessions. Some areas require the seller to pay the costs of attorney fees or a settlement attorney. If the seller agrees to this, it is important that you discuss how the payment will affect net proceeds.

NYC Transfer tax is required to purchase a New York City residence. This fee is charged by the New York State and city. For sales less than 500k dollars, the tax is 1%. For sales more than 500k it is 1.425%.

New York State Transfer Taxes are required in addition to NYC Transfer Tax. These taxes are as low as 1% if it is a single family home but can go as high as 2.075% if it is a multifamily property. The municipality or county may also charge recording fees. Information on recording fees is available at the National Conference of State Legislatures.

You should speak with a professional real estate agent if you want to sell a New York property. They will be able explain the process and assist you in negotiations. You will also receive an estimate of seller closing costs.

Apart from these closing costs, you'll also need title insurance. This insurance protects you against future title problems. An inspection of your property might be required by your lender. In order to make your property more desirable, you might need to make some repairs. If you have low equity, it may be necessary to pay for closing costs. It is a good idea to shop around for other providers, if possible.

FAQ

Is it possible for a house to be sold quickly?

You may be able to sell your house quickly if you intend to move out of the current residence in the next few weeks. There are some things to remember before you do this. First, find a buyer for your house and then negotiate a contract. Second, prepare the house for sale. Third, it is important to market your property. Finally, you should accept any offers made to your property.

What's the time frame to get a loan approved?

It is dependent on many factors, such as your credit score and income level. It generally takes about 30 days to get your mortgage approved.

What is a reverse mortgage?

Reverse mortgages allow you to borrow money without having to place any equity in your property. It allows you to borrow money from your home while still living in it. There are two types available: FHA (government-insured) and conventional. A conventional reverse mortgage requires that you repay the entire amount borrowed, plus an origination fee. FHA insurance will cover the repayment.

What are the 3 most important considerations when buying a property?

The three most important things when buying any kind of home are size, price, or location. It refers specifically to where you wish to live. Price refers to what you're willing to pay for the property. Size refers the area you need.

What are the pros and cons of a fixed-rate loan?

Fixed-rate mortgages guarantee that the interest rate will remain the same for the duration of the loan. You won't need to worry about rising interest rates. Fixed-rate loans have lower monthly payments, because they are locked in for a specific term.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

External Links

How To

How to locate an apartment

Finding an apartment is the first step when moving into a new city. This requires planning and research. It includes finding the right neighborhood, researching neighborhoods, reading reviews, and making phone calls. Although there are many ways to do it, some are easier than others. Before you rent an apartment, consider these steps.

-

Researching neighborhoods involves gathering data online and offline. Online resources include websites such as Yelp, Zillow, Trulia, Realtor.com, etc. Online sources include local newspapers and real estate agents as well as landlords and friends.

-

Read reviews of the area you want to live in. Yelp. TripAdvisor. Amazon.com all have detailed reviews on houses and apartments. You can also find local newspapers and visit your local library.

-

For more information, make phone calls and speak with people who have lived in the area. Ask them what the best and worst things about the area. Ask for their recommendations for places to live.

-

Take into account the rent prices in areas you are interested in. If you think you'll spend most of your money on food, consider renting somewhere cheaper. Consider moving to a higher-end location if you expect to spend a lot money on entertainment.

-

Find out about the apartment complex you'd like to move in. For example, how big is it? How much is it worth? Is it pet friendly What amenities is it equipped with? Can you park near it or do you need to have parking? Do tenants have to follow any rules?