Real estate is often referred to as "agent" and "broker". However, these titles don't necessarily mean the same thing. They require different skills.

There are some big differences between being an agent and a broker, so it's important to know the difference before you start your career. It is possible to determine which career path is best for you by understanding the differences between the two jobs.

Associate broker vs real estate agent

A broker license is required in order to be able to work. This requires extensive education, training, exams, and a lot more. It is well worth the effort. You can run your own brokerage, manage a team of agents or work with property management companies.

You can maximize your earning potential by becoming a broker. A broker can negotiate a higher share of your commission than an agent. This can boost your overall income and make the job more lucrative.

A realty agent, however, is paid on an hourly basis. That means they are paid when a deal goes through. They are usually either buyers or sellers and sometimes they do both.

They can assist clients in selling or buying a home. They also assist with final contract negotiations.

Brokers can also provide real estate services, such as rental assistance. This can help diversify your income. A broker is charged a fee to represent landlords and collect a percentage of rent from each tenant.

Brokers can also work in a supervisory role, overseeing other agents who have their own licenses and offices. They are able to ensure that agents comply with local regulations and follow the law, which is a great asset for many companies.

Brokers have many responsibilities and are often more involved than agents. They have to comply with a strict code of ethics, which helps protect their clients from unscrupulous business practices and misconduct.

To be able for a broker to work, they must also have the financial backing of the company. This will allow them to have a steady income and let them concentrate on their work without worrying about running out.

While obtaining a broker’s license may take time and money, it can lead to many more career opportunities. Additionally, brokers can have more experience that agents.

A higher income may be possible due to increased transactions and better commission splits. They may have greater control over the business and their personal decisions.

Whether you're a real estate agent or a broker, make sure to get the right training and certifications. This will allow for you to achieve the highest level of success and satisfy the needs of your clientele.

FAQ

How do I calculate my rate of interest?

Market conditions influence the market and interest rates can change daily. The average interest rate during the last week was 4.39%. Divide the length of your loan by the interest rates to calculate your interest rate. For example, if $200,000 is borrowed over 20 years at 5%/year, the interest rate will be 0.05x20 1%. That's ten basis points.

How do I know if my house is worth selling?

You may have an asking price too low because your home was not priced correctly. A home that is priced well below its market value may not attract enough buyers. Our free Home Value Report will provide you with information about current market conditions.

What should I look for in a mortgage broker?

A mortgage broker helps people who don't qualify for traditional mortgages. They look through different lenders to find the best deal. This service is offered by some brokers at a charge. Others offer free services.

How much will it cost to replace windows

The cost of replacing windows is between $1,500 and $3,000 per window. The total cost of replacing all of your windows will depend on the exact size, style, and brand of windows you choose.

What are the chances of me getting a second mortgage.

Yes. However, it's best to speak with a professional before you decide whether to apply for one. A second mortgage is used to consolidate or fund home improvements.

What amount of money can I get for my house?

It all depends on several factors, including the condition of your home as well as how long it has been listed on the market. According to Zillow.com, the average home selling price in the US is $203,000 This

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

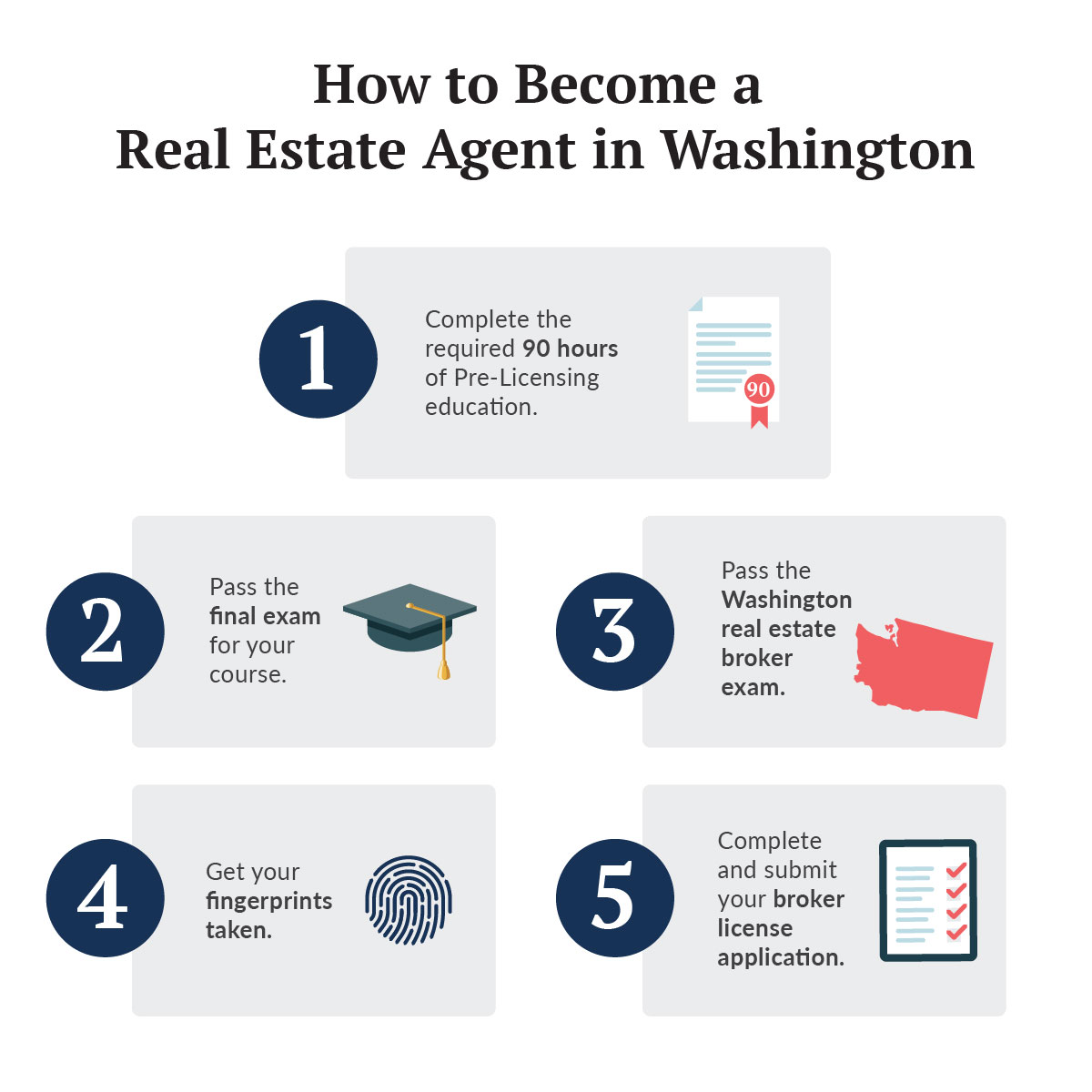

How to become a real estate broker

You must first take an introductory course to become a licensed real estate agent.

The next step is to pass a qualifying examination that tests your knowledge. This requires studying for at minimum 2 hours per night over a 3 month period.

This is the last step before you can take your final exam. In order to become a real estate agent, your score must be at least 80%.

If you pass all these exams, then you are now qualified to start working as a real estate agent!